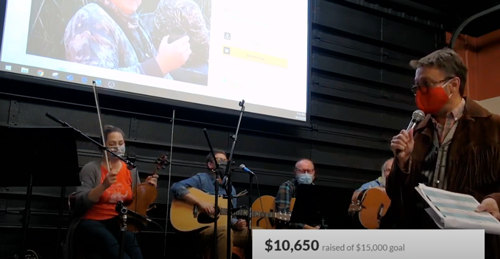

Our CEO recently MC’d a fundraiser for a friend whose health insurance wouldn’t cover the costs of his chemotherapy treatments. Why? Because he had purchased an inexpensive short-term insurance plan. The benefit raised thousands of dollars but also highlights the differences between short-term health insurance plans and their ACA counterparts, qualified health plans. Here’s a look at qualified health plans vs. short-term health plans:

Our CEO recently MC’d a fundraiser for a friend whose health insurance wouldn’t cover the costs of his chemotherapy treatments. Why? Because he had purchased an inexpensive short-term insurance plan. The benefit raised thousands of dollars but also highlights the differences between short-term health insurance plans and their ACA counterparts, qualified health plans. Here’s a look at qualified health plans vs. short-term health plans:

What is a qualified health plan (QHP)?

The Affordable Care Act (ACA) reformed the American health insurance marketplace. One way was by creating qualified health plans that must conform to requirements defined in the act. For example, qualified plans must provide essential health coverage and have limits on cost-sharing like deductibles and copays. Most people purchase qualified health plans on an exchange — either healthcare.gov or on their state’s exchange. Though you can buy qualified health plans on and off an exchange, the exchanges only sell qualified health plans and exchanges are the only place you can see if you qualify for a subsidy. Learn more about health insurance exchange terminology here.

Qualified health plans also generally exist in metallic tiers — bronze, silver, gold, and platinum — which differ in their respective premium and out-of-pocket costs. Bronze plans generally have lower premiums and higher out-of-pocket costs while platinum plans have the highest premium costs and the lowest out-of-pocket costs.

Qualified health plans offer ten essential services, which are:

- Ambulatory patient services (outpatient care)

- Emergency services (emergency room visits)

- Hospitalization (inpatient care)

- Maternity and newborn care

- Mental health services and addiction treatment

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive services, wellness services, and chronic disease treatment

- Pediatric services

What is a short-term health plan?

Short-term health plans are a type of insurance that’s primarily designed to fill temporary gaps in coverage when an individual is transitioning from one plan or coverage to another. For example, someone in between jobs, someone transitioning to Medicare, or other short-term insurance needs may be a good fit for a short-term health plan.

As a result, short-term health plans have none of the protections that qualified health plans have. For example, short-term health plans:

- Aren’t required to offer the essential health services offered in qualified health plans

- Usually don’t cover mental health, substance abuse, outpatient subscription drugs or maternity care

- Can exclude coverage for pre-existing conditions

- May cap the amount they pay to cover you either annually or over the term of the insurance policy

- Can limit how much they will spend on specific services like hospitalization

As a result, premiums are generally low when compared to QHPs. Though if you face a major medical event, out-of-pocket costs could be considerable.

The ACA and subsequent rules limited the duration of short-term health plans to as little as three months. In 2017, President Trump issued an executive order that aimed to modify regulations so that short-term insurance would be more available to encourage customer choice and provide competition in the health insurance market. As a result, in early 2018, the Departments of Health and Human Services (HHS), Labor, and the Treasury released a proposed rule that would extend the length of coverage for short term plans from 3 months to 364 days.

Qualified Health Plans vs. Short-term Health Plans

Who should buy a short-term health plan?

Short-term health plans were originally designed for individuals transitioning between coverages for a short period of time. They weren’t designed to be long-term insurance options. As a result, individuals who need a short-term plan between health coverage are the best fit for short-term health plans. Young and healthy individuals may be a good fit because of their low premiums, but keep in mind if you have any type of major medical item, a short-term health plan could be expensive.

Those with pre-existing conditions should likely stay away from short-term health insurance. You may get coverage, but your premium costs could be high and coverage levels poor. When considering short-term insurance, always read the fine print so you understand the services covered and at what levels. Make sure you understand your deductible, what percent of medical expenses you pay after meeting the deductible, the maximum out of pocket costs, and if a dollar cap on coverage exists. Also, check the plan’s network to see the doctors and hospitals included in the plan.

Who should buy a QHP?

Though the premiums may be higher, QHPs offer essential benefits, won’t charge higher premiums for pre-existing conditions, and generally will limit your out-of-pocket costs if you have an expensive medical procedure or issue. QHPs purchased on a state or federal exchange also qualify for a subsidy based on your income, so if you are under the income threshold, your premium costs could be lower. If you’re looking for a long-term insurance solution, QHPs are the obvious choice.

Certifi helps state health insurance exchanges improve enrollment and build a better member experience with state insurance exchange premium billing and payment solutions.