After the Affordable Care Act created state-based health insurance exchanges, many states had grand plans to develop thriving marketplaces where individuals could purchase health insurance. Unfortunately, off-the-shelf technology did not exist at the time, and building the infrastructure necessary to enroll hundreds of thousands of individuals in a health exchange was time-consuming, expensive, and fraught with error.

3 Reasons Your State Health Insurance Exchange Needs Consolidated Billing

-

- Improves Enrollment Experience

- Better Customer Experience

- Improves Your Exchange Brand

As a result, many states had less-than-ideal rollouts. Oregon launched without the ability to enroll individuals on its website. Minnesota had significant delays in its call center due to its technology platform. The Massachusetts website was incomplete and error-prone and had issues applying payments to accounts. Maryland had issues enrolling individuals.

As a result of these well-publicized failures, many states scaled back the scope of their exchanges. For many, that meant that instead of offering consolidated billing, they focused on making their enrollment and plan selection tools easier to use and functional. Reducing the scale of their exchanges enabled them to get enrollment tools up and running faster but at a cost. More on that later.

Health Insurance Exchange Developments

Flash forward to today. Two developments have led states that formerly leveraged the federal healthcare.gov site for their exchange to consider transitioning to a state-based exchange:

- The federal government increased the fees states must pay to use the federal marketplace

- Off-the-shelf enrollment technology is now easier and less costly to implement compared to the custom builds that existed when the exchanges were first created.

As more states create state-based health insurance exchanges and as early-adopting states continually improve their existing technology platform, there is an opportunity for a better member experience. Today, most states manage enrollment for their exchange, offloading billing, and payment management to insurance carriers.

Yet that approach hurts states’ ability to deliver a great customer experience that maximizes enrollment. Here are three reasons why states should add health insurance exchange consolidated billing:

1. Improved Enrollment Experience

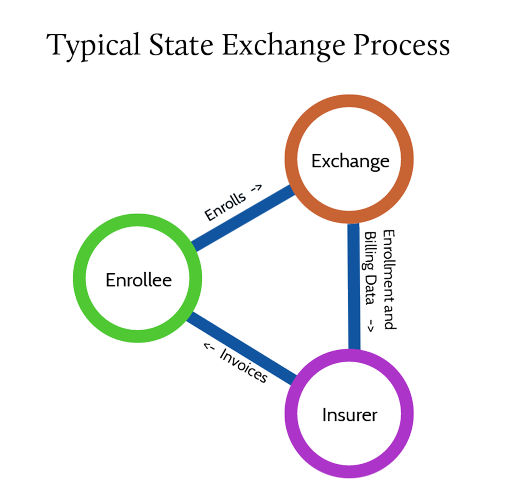

In states without consolidated billing, typically the enrollee starts by selecting a plan. After plan selection, the exchange sends their enrollment data to the carrier. The carrier then bills the enrollee.

That process leads to a poor enrollment experience. For example, any disruption or error in communicating the enrollment data to the carrier delays sending an invoice to the enrollee and thus the payment. It also leads to the possibility that the member goes to the doctor and gets denied initially because no payment exists in the insure’s system.

The process also impacts a state exchange’s bottom line. Most marketplaces charge insurers a percentage of insurance premiums billed in the marketplace to pay for their operations. By failing to collect payment upon enrollment, the odds of an enrollee failing to effectuate enrollment increases. Which decreases the revenue generated by the state exchange.

Consolidated billing should be implemented within the enrollment platform so the platform presents the enrollee with payment options immediately after plan selection. The enrollee can make a binder payment, and the billing provider can send that information to the carrier. The process is easier for the enrollee and the insurer.

2. Better Customer Experience

Consolidated billing also improves the customer experience. In addition to offering medical insurance plans, the state insurance exchanges also offer dental insurance plans. Consumers will also potentially receive two different bills – one for medical insurance and the other for dental insurance.

Consolidated billing eliminates the need for the customer to make multiple payments to multiple carriers. Instead, they’ll receive one consolidated bill, access one payment portal to pay their bill, and the billing provider handles dividing the payment into separate disbursements for the carriers and any commissions to brokers as well as calculating subsidies. Again, the process is easier for the enrollee and also easier for the carrier because they no longer need to manage the billing and payment process. Adding more

3. Improves Your Exchange Brand

When Steve Jobs ran Apple, he was maniacal about simplifying products and product lines. He wanted simple, easy-to-use products. He also believed in minimal SKUs to limit choices consumers must make. The idea was to simplify buying decisions and make products that were easy to use.

That dedication led to Apple growing into one of the linchpins of the American economy. And it also wove its way into Apple’s brand. Apple was rarely the first to market with great innovation. But they were usually the most polished to market. That brand identity helped Apple grow into the market behemoth it is today.

Brand reputation matters. Simplifying enrolling and paying for insurance increases the likelihood of earning repeat customers. The budgets that state exchanges have allocated to marketing and outreach can be in the tens of millions of dollars. But a poor customer experience – highlighted by a confusing array of bills and payment options – leaves a poor brand impression, making it harder to attract and retain customers.

Consolidated billing can help by ensuring everything related to acquiring insurance – enrollment as well as billing and payment – is handled by the state exchange. That gives the exchange 12 touchpoints every year that they otherwise wouldn’t have. Exchanges can use those touchpoints to message about open enrollment, subsidies, or other exchange-related topics that help reinforce its brand.

Certifi helps private and public health insurance exchanges improve enrollment and build a better member experience with health insurance exchange consolidated billing and payment solutions.