Health and Human Services (HHS) recently released data related to the 2021 Special Enrollment Period (SEP) in the health insurance exchanges created by the Affordable Care Act (ACA). That data highlighted the enrollment gains the SEP introduced to the federal Healthcare.gov marketplace as well as state-based health insurance exchanges.

Let’s take a look at the impact of the 2021 ACA Special Enrollment Period.

What is an ACA Special Enrollment Period?

First, let’s explain what the term Special Enrollment Period means. A Special Enrollment Period is essentially a time outside of the annual enrollment window — which will be from Nov. 1, 2021, to January 15, 2022, for the 2021 ACA open enrollment period — when individuals can enroll in health insurance on one of the health insurance marketplaces created by the ACA. Normally, to enroll in a health plan outside of the annual enrollment window, an individual would need a qualifying event. The Special Enrollment Period allows anyone to enroll in a health plan.

Click here for explanations of more health insurance exchange terminology.

When was the 2021 ACA Special Enrollment Period?

Initially announced in early February, the 2021 Special Enrollment Period for the federal health insurance marketplace was scheduled to occur from February 15 to May 15, 2021. In March, the SEP was extended until August 15, 2021. The extension allowed individuals to take advantage of new subsidies made available by the American Rescue Plan Act (ARPA).

How did enrollment compare to previous years?

Enrollment in the federal healthcare.gov exchange was strong during the Special Enrollment Period. In the federal healthcare.gov exchange, nearly 2.1 million Americans signed up for new insurance coverage between Feb. 15 and Aug. 15. Another 738,000 enrolled on state-based exchanges.

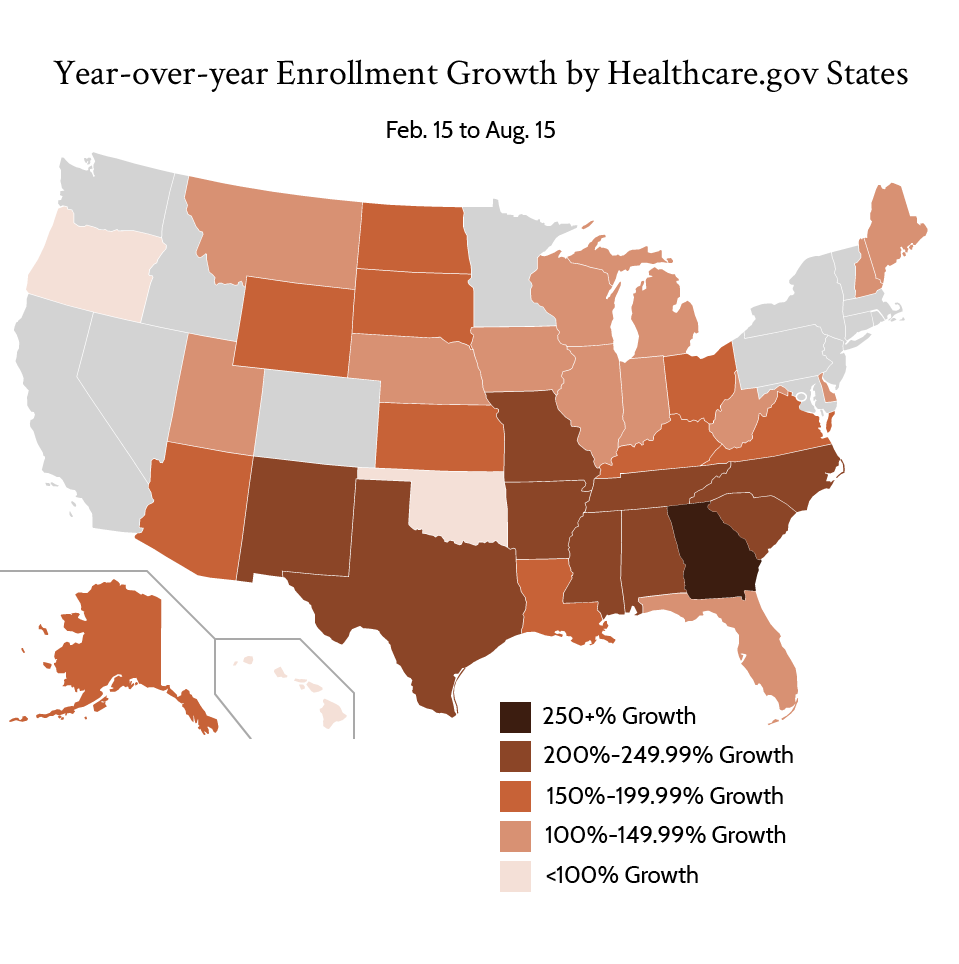

Enrollment in the federal exchange nearly tripled the same time period from 2020 and almost quadrupled 2019s enrollment from Feb. 15 to August 15. Florida (542,067) and Texas (416,987) accounted for nearly 1 million enrollees, compared to less than 350,000 in the same period in 2020. Every state on the federal exchange saw an enrollment increase from the previous year. Most at least doubled the number of enrollees in 2021 compared to the same period in 2020. The states with the most enrollment gains were generally those that have not yet expanded Medicaid, likely because they typically experience the highest uninsurance rates.

What was the demographic breakdown during the 2021 ACA Special Enrollment Period?

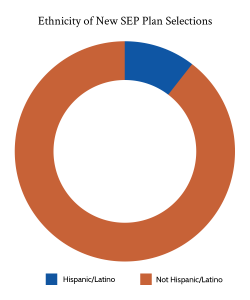

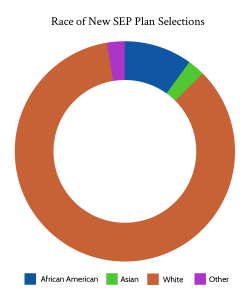

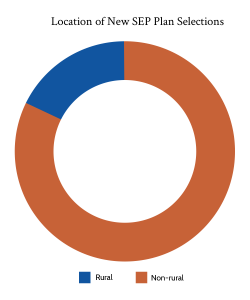

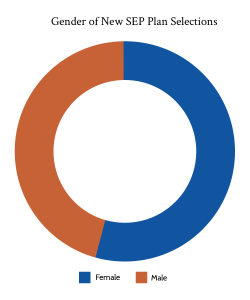

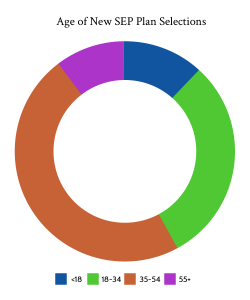

Demographically, those who enrolled during the SEP were slightly more likely to be aged 35-54. Enrollees were also slightly more male, and slightly more rural when compared to the same time period the previous year. That said, those differences were slight. Of those reporting their race, 15% of enrollees were African American, up from 11% in 2020 in the same period. Whites meanwhile dropped from 75% of enrollees in 2020 to 71% in 2021. Hispanic/Latino were about 19% of those who reported an ethnicity, up slightly from the same time period in 2020. From a household income perspective, the cost savings created by ARPA likely led to more households with income 400+% of the federal poverty level to enroll, although that demographic only accounted for 7% of enrollees.

What cost savings did enrollees experience due to ARPA?

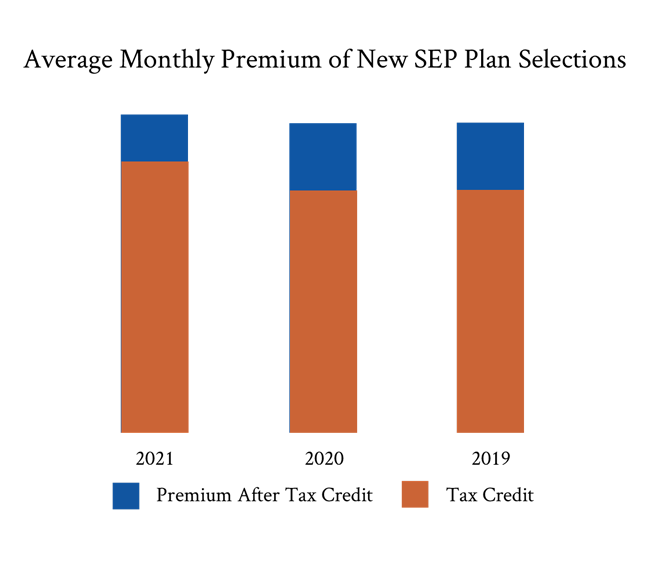

The American Rescue Plan Act was signed into law in March of 2021. Essentially, it expanded the eligibility of premium subsidies to those with household incomes above 400% of the federal poverty level while also increasing subsidies available to those below 400% of the federal poverty level. In fact, the average monthly premium for those who enrolled on the federal exchange during the SEP was $81 after premium tax credits, compared to $117 the previous year. The average premium subsidy also increased from $418 to $468.

New enrollees weren’t the only ones to benefit from the ARPA subsidy increase. Existing enrollees were able to take advantage of those subsidies as well. The average existing federal marketplace enrollee paid $56 for their monthly premiums after subsidies, a decrease of $53. Overall, new enrollees had their premiums reduced by nearly $1 billion per month thanks to premium subsidies.

From an enrollment perspective, the SEP clearly succeeded, pushing effectuated exchange enrollment to record highs.

Certifi helps private and public health insurance exchanges improve enrollment and build a better member experience with health insurance exchange consolidated billing and payment solutions.