The Affordable Care Act encouraged enrollment in healthcare exchanges by levying a penalty if an individual didn’t have health insurance. Called the individual mandate, penalties ranged from $695 per individual or 2.5% of household income, whichever was greater. In the summer of 2017, Congress removed the penalty attached to the individual mandate.

Maryland looked for alternatives to the individual mandate to improve enrollment and stabilize the state’s health insurance exchange market. Ideas included a down payment plan in which, instead of paying a penalty, the uninsured could put that money toward a down payment in an exchange health care plan. The idea stalled, however, because it required building new administrative capability and because the state doesn’t directly handle premium dollars.

Ultimately, Maryland decided to take a voluntary approach to insurance enrollment. Called the Maryland Easy Enrollment health insurance program, it leverages tax filings to encourage enrollment. The legislation passed with unanimous support in the Senate and bipartisan support in the House.

Why is the Maryland Easy Enrollment Health Insurance Program Necessary?

Maryland had an estimated 360,000 uninsured residents in 2016, approximately 130,000 of which were income-tax filers who qualified for free coverage, in the form of Medicaid or CHIP, or those eligible for premium tax credits that would cover the entire premium cost of a qualified health plan. Another 90,000 uninsured residents also likely qualified for premium tax credits that would cover a portion of health insurance premium costs.

Maryland also found that many of those uninsured didn’t realize that they could enroll in free or subsidized insurance. A national survey found that 44% of those with incomes below 250% of the federal poverty level weren’t aware of exchanges. Additionally, 55% didn’t know that they could use financial assistance to help buy insurance.

Because 70% of uninsured filed taxes, Maryland determined they could make a significant impact on enrollment in both insurance affordability programs like Medicaid and CHIP as well as the health insurance exchange. Increasing enrollment in the exchange would bring more insurers to the market and likely drive down prices for all residents.

How Does the Maryland Easy Enrollment Health Insurance Program Work?

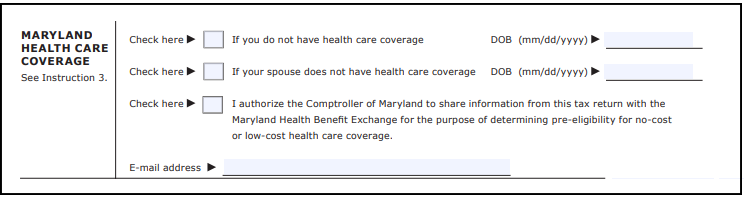

The Maryland Easy Enrollment health insurance program identifies residents who don’t have insurance using annual tax filings. Residents voluntarily check a box on their Maryland income tax return to send their information to the health insurance exchange. The exchange then determines the resident’s eligibility for public programs like Medicaid and CHIP. If eligible, they’ll be automatically enrolled.

If the tax filer fails to qualify for those programs, they immediately qualify for a special 35-day enrollment period. The enrollment period starts after the exchange sends an eligibility notice informing. The exchange also determines if they’re qualified for any tax credits. If they are eligible, individuals leverage the state exchange to find a health plan.

Maryland personalizes the notice sent to an individual based on the information gathered on the tax form. Follow up includes:

- A letter shortly after checking the box

- Two emails sent if the individual provided an email address

- If the individual starts but doesn’t complete the application process, the exchange sends them three emails. The exchange sends the emails once every three days to encourage completed applications.

- The exchange also A/B tested sending a postcard toward the end of their 35 days to encourage enrollment

The program is completely voluntary. Individuals wishing not to be considered for insurance options simply choose not to check the box to share information. The Easy Enrollment program went live for the 2019 tax year. Individuals were able to check the box in early 2020.

How Did Maryland Promote the Program?

Maryland leveraged several tactics to help residents understand the new program. It started with a kickoff press conference featuring Baltimore Oriole baseball legend Eddie Murray followed by webinars for tax partners, brokers, and consumer assistance organizations. The Maryland Health Connections website included messaging about the program and a new webpage dedicated to the program. A social press kit was created for partners and emails were sent to consumers from February to April of 2020 about checking the box and the next steps in the process. They created a two-minute video, and press releases announcing the program and announcing the first consumer to check the box. They also spent $70,000 on digital advertising for the program.

What Was the Result in 2020?

The coronavirus pandemic extended the tax filing deadline to July 15 as well as created a special enrollment period for Maryland residents. As of a late July press release, Maryland saw more than 41,000 tax filers check the box on their tax return and 3,700 of them had enrolled in coverage. Because the tax filing deadline had been delayed to July 15, final numbers wouldn’t be available until late August. Maryland has not released final numbers as of this writing.

Certifi helps state health insurance exchanges improve enrollment and build a better member experience with state insurance exchange premium billing and payment solutions.