The 2022 Medicare Advantage open enrollment period recently ended. In early March, the Chartis Group released an in-depth examination of the Medicare Advantage market. Among the findings:

- Enrollment in general and as a percent of all Medicare continues its growth. Medicare Advantage saw a 9% increase in enrollment and now counts 45% of all Medicare beneficiaries

- Medicare Advantage added 2.3 million lives, while original Medicare saw a decrease of 1 million.

- Nearly ¼ of the 50 states now have half or more eligible beneficiaries using Medicare Advantage plans.

- For-profit companies outpace their non-profit and Blues plan counterparts with 71.8% of the market share.

- United and Centene saw strong market share growth, while Humana and Kaiser experienced the largest market share contraction.

- Finally, startup health plans now share 1.3% of the market, up from 0.9% last year.

With that context, let’s take a look at how 3 health plan startups fared in the recent Medicare Advantage open enrollment period.

What is Medicare Advantage?

But first, let’s take a quick look at Medicare Advantage. Original Medicare is comprised of Part A, which helps cover in-patient hospital care, skilled nursing facility care, hospice care, and home health care. Part B covers doctors, outpatient care, home health care, medical equipment like wheelchairs, and many preventive services like screenings and wellness visits. Part D covers the cost of prescription drugs. Many individuals on original Medicare also get supplemental insurance coverage, called Medigap, that helps pay for an individual’s out-of-pocket costs. Original Medicare members can use any doctor or hospital in the US that accepts Medicare.

Medicare Advantage, Part C, on the other hand, is managed by private companies. They typically bundle Part A, Part B, and Part D coverage into one plan. They also typically have a plan network that members must use. That restricted network may lead to lower out-of-pocket costs compared to original Medicare. Some plans also offer additional services like vision, hearing, or dental coverage.

With that in mind, let’s take a look at three Medicare Advantage health plan startups and examine why they may be taking market share from their much larger competitors.

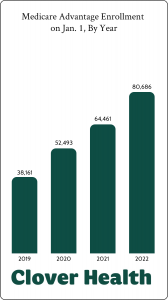

Clover Health

Clover Health

Clover Health sells Medicare Advantage plans in 209 counties across Alabama, Arizona, Georgia, Mississippi, New Jersey, Pennsylvania, South Carolina, Tennessee, and Texas. Founded in 2014, Clover Health went public in early 2021. One of Clover’s distinguishing features is its machine learning platform, the Clover Assistant, which delivers recommendations to care providers based on aggregated health information.

In early January, the company announced Medicare Advantage membership growth of 25% compared to the beginning of 2021. Clover went from 64,461 to 80,693 Medicare Advantage enrollees. Clover also announced that it had tripled its membership in Georgia thanks to adding nearly 5,000 new care providers to its network.

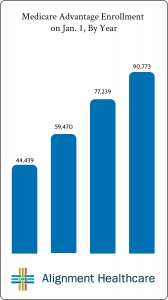

Alignment Health

Alignment Health

Founded in 2013, Alignment Healthcare sells Medicare Advantage plans in 38 markets in Arizona, California, Nevada, and North Carolina. Like Clover Health, the company went public in 2021. And like Clover, Alignment Healthcare melds artificial intelligence through its AVA technology platform into its plan. The platform can use that AI and machine learning to predict care alerts such as a risk for hospitalization and then enable a proactive outreach program.

According to Healthcare Dive, Alignment saw a nearly 18% increase in Medicare Advantage enrollment growth from January 2021 to January 2022, going from 77,239 to 90,775 enrollees. The company offered a number of unique plans in 2022, including a new $0 premium HMO plan for the Hispanic American community that features a Spanish-speaking provider network.

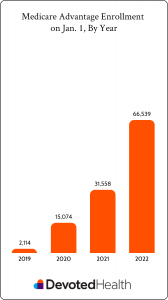

Devoted Health

Devoted Health

Devoted Health is one of the newest Medicare Advantage startups, having been founded in 2017. Today, it sells plans in Arizona, Florida, Illinois, Ohio, and Texas. The company differentiates itself through strong customer service. It leverages what it calls Guides to help members navigate the healthcare system. They also have their own virtual and in-home care unit — Devoted Medical — that delivers telemedical and in-home services to members. Like Clover and Alignment, Devoted also leverages an end-to-end technology platform — Orinoco — to manage the experience.

Healthcare Dive reported that Devoted Health more than doubled its enrollment from 2021 to 2022. The company grew from 31,558 members to 66,461. In addition to growing their territory in existing states, in 2022 the company expanded into the Chicago area. Additionally, Devoted’s plans in Texas and Florida earned a 4.5 out of 5 Medicare Advantage star rating in their first year of eligibility, likely helping them achieve growth in those states.

Buoyed by Devoted Health’s explosive growth, these three Medicare Advantage health plan startups saw 62% growth from January 2021’s enrollment to January 2022’s enrollment when Medicare Advantage as a whole saw growth of 9%. That’s impressive growth that likely is drawing the attention of their larger peers.

Certifi’s health insurance premium billing and payment solutions help Medicare Advantage payers improve member satisfaction while reducing administrative costs.