Bad reviews matter. According to research, bad reviews on sites like Google, Facebook, and Yelp impact revenue: a business with a 1 to 1.5 star Google rating will report 33% less revenue than the average enterprise. Forbes reports that 94% of consumers avoid a company with bad reviews.

Negative reviews impact the bottom line. It’s no different in the Medicare Advantage marketplace. The Centers for Medicaid and Medicare Services (CMS) uses a five-star rating system to rate the quality of each plan in the market. A recent analysis by Navigant found that for plans with 3 stars or less, a 1-star improvement could lead to an 8 to 12 percent increase in enrollment. Moving from a 3 star to 4-star plan could increase revenue between 13.4 and 17.6 percent. As a result, insurers who focus on improving star ratings earn more revenue.

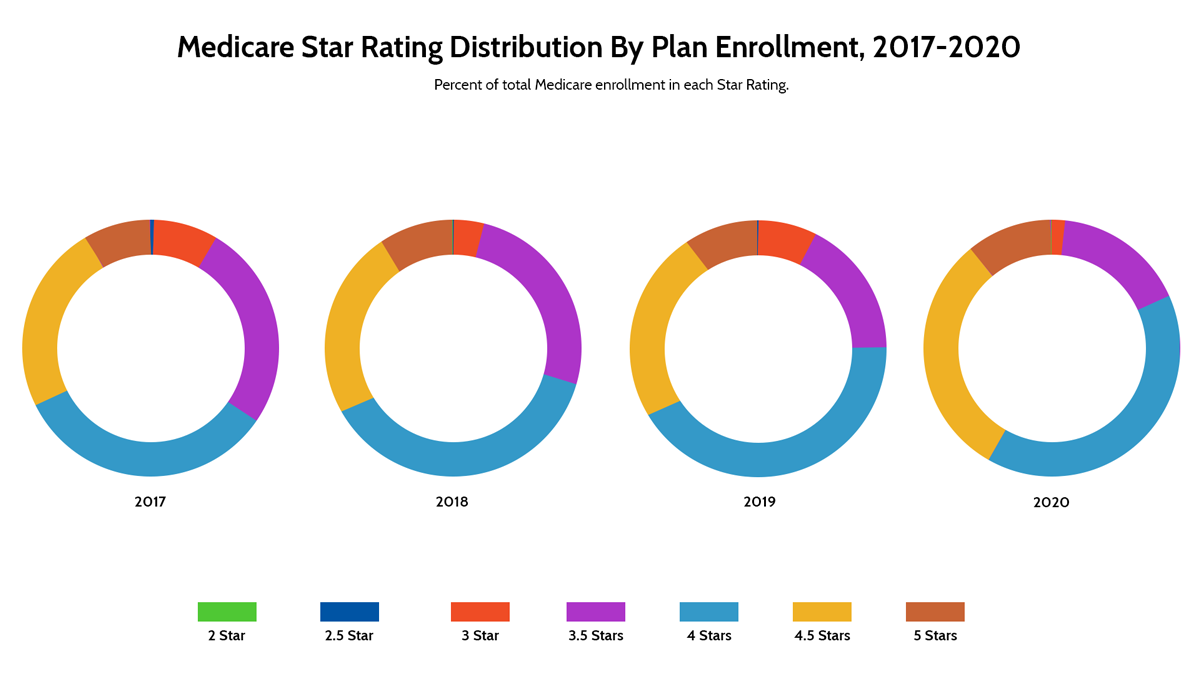

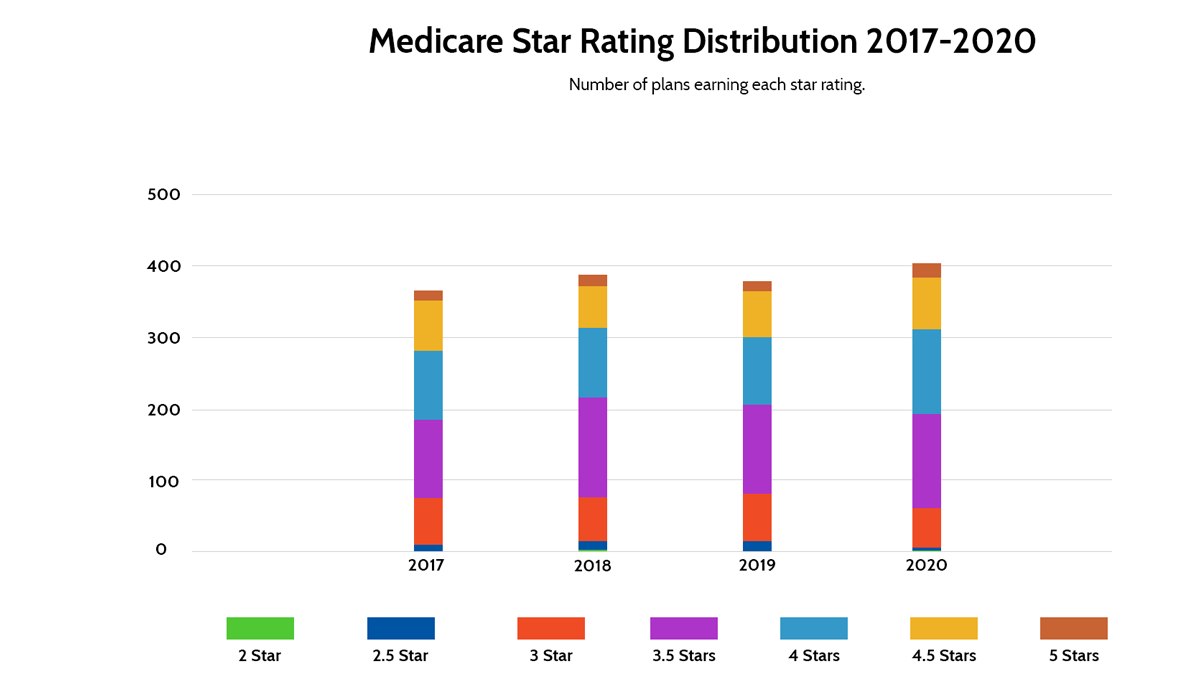

With that in mind, let’s take a look at Medicare Star Ratings for insurers:

What are the Medicare Star Ratings?

The Medicare Star Rating system began back in 2007 as a way for CMS to focus on improving plans and enable Medicare beneficiaries to compare plans. The stars measure the quality of health and drug services beneficiaries receive through Medicare Advantage and Prescription Drug Plans. Since 2009, CMS has published Medicare Part C and D Star Ratings each year.

What is measured?

Medicare Star Ratings measure more than 30 different topics in five categories for Medicare Advantage plans and 14 topics in four categories for Medicare Part D prescription drug plans. Plans that are both Medicare Advantage and Part D are measured across more than 45 topics in 9 categories.

The table below outlines the categories for each plan type:

Medicare Advantage |

Medicare Part D |

| Staying Healthy

Plans are rated on access to preventive services that keep members healthy, like flu shots and screenings. |

Customer Service

Plans are rated on how well the plan handles member appeals and call center performance and capabilities. |

| Managing Chronic Conditions

CMS rates plans for how they coordinated care and how frequently members received services for long-term health conditions. |

Member Complaints and Plan Performance

Plans are rated on the frequency of complaints, whether they had issues getting services and whether performance measures increase year-over-year. |

| Member Experience

Measures the member experience, like how easy it is for members to get needed care and seeing specialists. |

Member Experience

Measures the member experience, like members rating of drug plans and the ease with which prescriptions are filled. |

| Member Complaints and Performance

Plans are rated on the frequency of complaints, whether they had issues getting services and whether performance measures increase year-over-year. |

Drug Pricing and Patient Safety

Measures the accuracy of drug pricing and adherence to taking prescribed medication. |

| Customer Service

Plans are rated for call center services as well as processing appeals and new enrollments promptly. |

How are those criteria measured?

CMS gathers data used in the Medicare Star Ratings for insurers from multiple sources, including the health and drug plans, enrollee surveys, data from CMS contractors, and CMS administrative data. Generally, CMS uses individual topic measures to score each of the general categories listed above and applies a weight from 1 to 5 for each of those category scores to get an overall rating. For more information, see the CMS technical documentation: https://www.cms.gov/files/document/2021technotes20201001.pdf-0

How can insurers increase their Star Rating?

For 2020, a total of 23 plans earned a high performer indicator, which indicates they earned 5 stars. Of those, most were Medicare Advantage and Part D plans. Nine of those contracts did not receive that distinction in 2020. The takeaway: It is possible to improve your ranking. That said, doing so takes strategic and tactical excellence, as CMS weights scores against other plans. You need to outperform other plans to improve your Star Rating.

Here are some tips on how to increase your star rating:

Focus on Incremental, Sustainable Improvements

First, make improving your Star Rating a priority. Create a team focused on driving change within the organization. Start by identifying areas of improvement — like how to deliver better care quality or how to deliver better provider support — and start small. Because a series of small wins will, over time, lead to significant improvements, think small to start.

Insurer/Provider Collaboration

A portion of your star rating is based on the quality of care received by beneficiaries. For example, access to a health screening may be part of your score, but the provider is generally responsible for ordering that screening.

Building mutually beneficial relationships with providers and their staff is the key to encouraging them to perform services and gathering the information needed related to Star Ratings. That relationship starts with a provider strategy, internal training, and tracking to ensure that adequate follow-up occurs.

Improve Your Member Experience

A significant portion of Medicare Star Ratings for insurers is based on the member experience. As a result, if you can improve that experience, you’ll be closer to your goal of a higher rating. So, how do you do that?

Often, it starts with communication because many members don’t know what they don’t know. They’re not aware of the services available to them through your health plan. So, your job is to introduce them to those services. Think of your communication plan like a marketing campaign; building a comprehensive communication plan that introduces the right information at the right time is the key to success.

So, listen to your members. Your Star Ratings in large part illustrates a member’s experience with your health plan. Patient-reported measures comprise much of the information on which your plan’s quality score relies because several datasets are based on a patient’s perception of care.

As a result, investments in listening to your members pay off. Build processes to continually solicit and monitor their feedback and create a prioritized list of items to review and improve. Because you understand what’s making members unhappy (or happy), you will be better positioned to continually improve the member experience.

It also helps to have friendly, well-trained customer service representatives. Learn more about insurance customer service representative training in a recent blog post.

Invest in Digitization and Automation

Finally, investing in technology that can streamline processes and eliminate time-consuming tasks will free your staff to take a broader view of every member interaction and spend more time focusing on member needs. For example, artificial intelligence can help you surface progress notes and discharge summaries and find members in need of follow-up. It can help you identify providers who do and don’t consistently have gaps in care, so you can deliver targeted outreach to select providers. Leveraging artificial intelligence to comb through your data to find items in need of follow-up can significantly improve the member experience.

For more AI use cases in health insurance, read our recent blog post.

Looking Toward the Future

CMS will weight your member experience more heavily beginning in 2023’s star ratings. The weight assigned to the member experience score will increase from a 2 to a 4 beginning in 2023. As a result, insurers must begin to implement changes as soon as possible because data from the member experience category will begin to be taken as early as late 2021.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.