One of the central tenets of American capitalism indicates that competition is good for consumers and businesses. When businesses compete, consumers get better prices and the quality of goods and services increases. Additionally, that competition results in new and novel ways to serve customers and the broader market, leading to faster innovation.

As a result, competition leads to a thriving economy. Unfortunately, a recent US Government Accountability Office (GAO) report on the state of private health insurance markets found the health insurance market generally became more concentrated in 2017 and 2018 for those in individual and small group markets.

Background

For health insurance, increased competition can lead to lower premiums for consumers and a larger variety of plans. The GAO periodically measures the concentration in a market by reviewing data from the Department of Health and Human Services (HHS) and the Centers for Medicare and Medicaid Services (CMS) to determine the number of insurers and their market share. Markets are considered concentrated if 3 or more insurers have at least 80% of the market share in a given state.

Individual Market

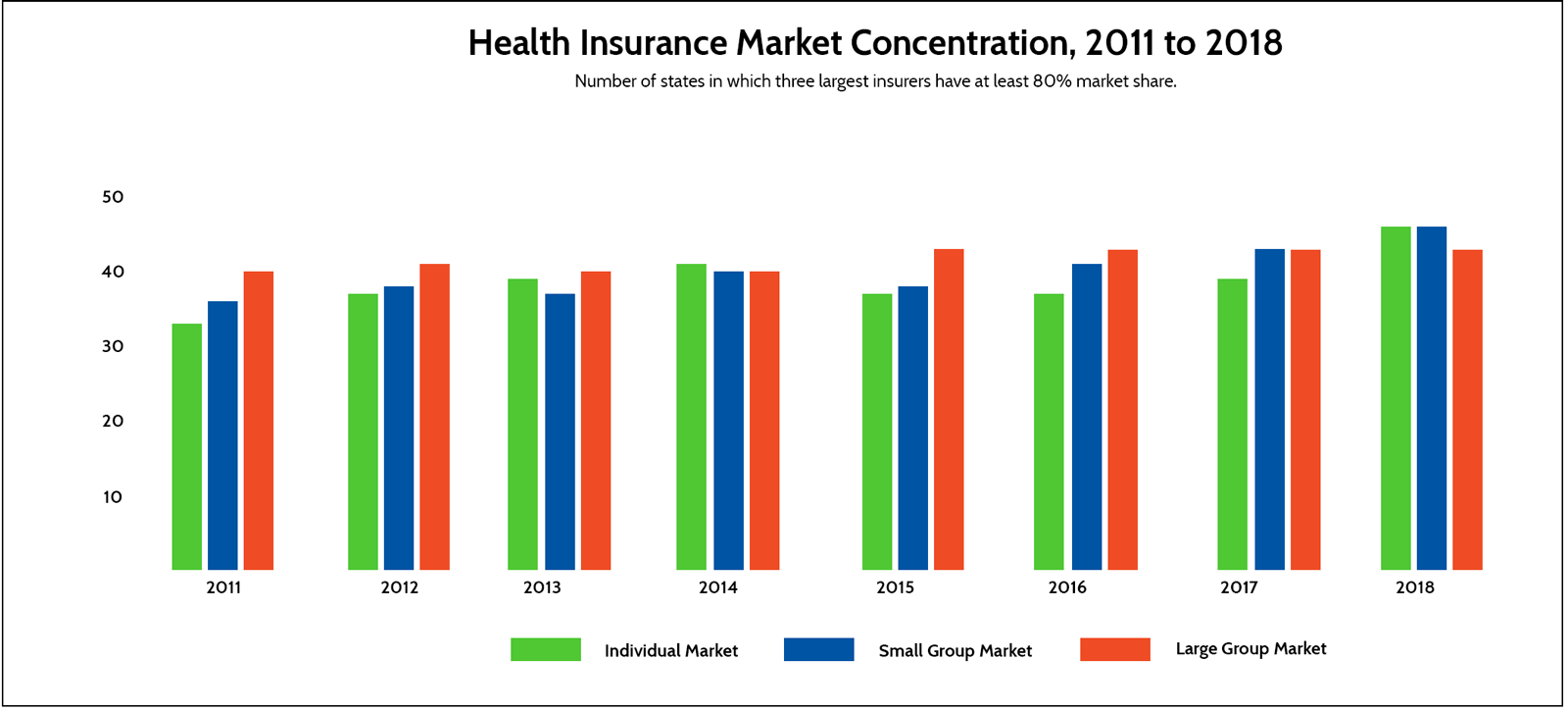

Though there was a slight decline in the number of states that were considered highly concentrated in 2015 and 2016, states became more concentrated in 2017 and 2018. GAO found the number of states with three insurers combining to own more than 80% of the market share went from 33 in 2011 to 41 in 2014, then declined to 37 in 2015 and 2016, before rising to 39 in 2017 and ultimately settling at 46 in 2018.

Other signs of high health insurance market concentration exist. The median market share of the three largest issuers in a state increased from 85% in 2011, to 90% in 2015 and to 98% in 2019. From 2017 through 2018, 34 states saw increases in concentration among the three largest issuers. Conversely, just 8 states experienced decreases.

Though the federally facilitated individual market exchanges were designed to increase competition in individual health insurance markets, the GAO found that all 39 federal exchanges were highly concentrated in 2017 and 2018. Additionally, GAO found that from 2015 to 2018 the number of states with three or fewer insurance companies in the federal exchange increased from 13 to 32.

Takeaway: The individual health insurance market became more concentrated in 2017 and 2018.

Small Group Market

The small group market, like the individual health insurance market, experienced an increase in market concentration. In 2015, the GAO found 38 states to be highly concentrated. That increased to 41 in 2016, 43 in 2017, and 46 in 2018. Additionally, the median number of insurers declined from 9 per state to 5 per state from 2015 to 2018. A remarkable 11 states had a single insurer with at least 80% of market share, up from 6 in 2015.

Other signs also point to a more concentrated small group market. The median market share of the top 3 issuers increased 5 percentage points from 2015 to 2018, increasing from 89% to 94%. A related development found 41 states that experienced an increase in market share among the three largest insurers, while just five saw market share among the top three insurers decrease.

Missouri (7.2 percentage points), Connecticut (7), New Jersey (6.9), Georgia (6.9), and Virginia (6.8) all saw market share among their top three insurers increase by more than 6 percentage points from 2017 to 2018.

Takeaway: Like the individual health insurance market, the small group health insurance market became more concentrated in 2017 and 2018.

Large Group Market

The large group market saw some slight increases in some market concentration metrics. That said, as a whole, large group market concentration remained relatively unchanged from 2011 to 2018.

First, the indicators of increased health insurance market concentration. The median number of insurers did drop — from 12 in 2011 to 9 in 2018. Also, the number of states with a high concentration of insurer market share increased from 40 to 43. However, that number has remained unchanged — at 43 — since 2015, indicating a stabilized market for large groups. Additionally, a single insurer had more than 80% of the market share in 8 states in 2018. Seven states experienced a single insurer with more than 80% market share in 2015.

Unlike the small group market, a considerable number of states experienced decreases in market concentration from 2017 to 2018. Though 28 states saw increases in market share amount their top three insurers, 22 states experienced decreases. The median increase was roughly 1 percentage point, slightly more than the median decrease of less than 1 percentage point. Kentucky (5.8 percentage points) was the only state that saw market share increase by more than 5 percentage points.

Takeaway: Unlike the individual and small group health insurance market, the large group health insurance market has been fairly stable. A limited increase in market concentration exists.

To read the full GAO report, visit https://www.gao.gov/assets/720/710634.pdf.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.