Poor payer premium billing practices can significantly impact member satisfaction. Take the Gaffers: They thought they had paid their insurance premium but had sent the payment to their health plan’s hospital. The health plan canceled their coverage for non-payment while Mrs. Gaffer was six months pregnant.

The health plan corrected the issue only after negative publicity likely impacted its brand.

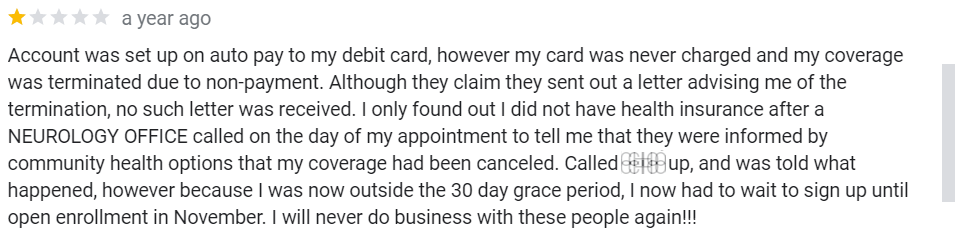

Or, take many negative customer reviews for another health plan from members who say they had set up auto-payments with the health plan but had their insurance canceled for non-payment.

Worse, as much as 50% of calls to member service teams are billing-related. Those interactions likely drive down Net Promoter Scores for health plans. Recent Qualitrics NPS data shows that health plans’ average NPS score of 24 beats only internet providers and TV services among large industries.

So how do health plans drive up member satisfaction and NPS scores? By investing in a modern premium billing software solution. Here are five ways premium billing software improves member satisfaction for health insurers:

Accuracy and Timeliness

Premium billing software can help ensure insurers accurately calculate member premiums and bill members on time. Accurate, timely invoices reduce billing errors, minimizing member confusion and frustration. By sending accurate invoices on time, members are more likely to trust their health insurer and feel satisfied with their service.

How does modern premium billing software improve billing accuracy? At Certifi, we leverage a unique Perfect Balance design that couples debits and credits to ensure the accuracy of invoices, retroactive adjustments, and remittances.

Additionally, modern software uses cloud technology that enables easier scaling. Creating monthly billing financial transactions can be a computing resource-intensive task. By leveraging modern cloud technology, vendors can use elastic computing resources, adding and removing computing power as needs dictate. That leads to faster processing and more timely invoice delivery.

Flexibility and Convenience

Premium billing software offers more flexible payment options for members, such as one-time online payments, automatic billing, and even retail cash payments for monthly health insurance premiums. Providing a more convenient and accessible payment process increases member satisfaction.

Payment flexibility is another way premium billing software improves member satisfaction. Members prefer to select the date to pay their payment account. For example, the member may get paid on the 5th and want a payment made on the 6th. You can configure premium billing software to offer specific dates to withdraw the automatic premium payment. Though we recommend not leaving those payment dates too broad, offering four or five dates each month should accommodate most members.

Members enjoy making a payment when it’s convenient for them. Health plans likely will also see more members select automatic payments, improving on-time payment rates.

Transparency and Communication

Premium billing software delivers detailed information about member premiums, including breakdowns of costs and benefits. As a result, members better understand their premium invoice and feel more informed about their healthcare costs. Additionally, the software can send timely and personalized communications to members about their bills, reducing confusion and frustration.

For example, we learned above that the Gaffers lost their insurance for non-payment. Yet, their insurer never notified them that their account was delinquent. Had the insurer sent a delinquency notification indicating that the Gaffers’ payment was late, the Gaffers likely would have contacted the insurer to rectify the situation.

Why didn’t the insurer send a delinquency communication? Likely because doing so manually, without premium billing software, can be costly. But modern premium billing software includes integrated delinquency management for health insurers to automate the entire process. Health plans can even leverage email communications for real-time notifications. Automated delinquency management results in fewer aged receivables and happier members.

Security and Privacy

Premium billing software can ensure the security and privacy of member information, including their personal and financial data. It may seem counter-intuitive, but cloud-based solutions can be more secure than on-premise, especially if you don’t have the resources and staff to invest in on-premise security tools. The provider maintains and updates much of that security infrastructure in cloud applications.

Better security practices can improve customer satisfaction. No member wants to receive a privacy breach notice, and receiving one can impact satisfaction and retention rates.

Customer Service

Premium billing software can help insurers provide better customer service to their members. For example, the software can automatically send payment reminders or confirmations to members, reducing the need for customer service calls. Health plans can integrate detailed billing information – including PDF copies of invoices – into your member portal for better member self-service. Additionally, the software can flag billing issues, such as missed payments or coverage changes that require billing adjustments, allowing health plans to resolve issues proactively.

Customer service teams can also access real-time billing information in the premium billing software. That enables fast resolution of member questions about invoices, payments, and other billing-related information.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.