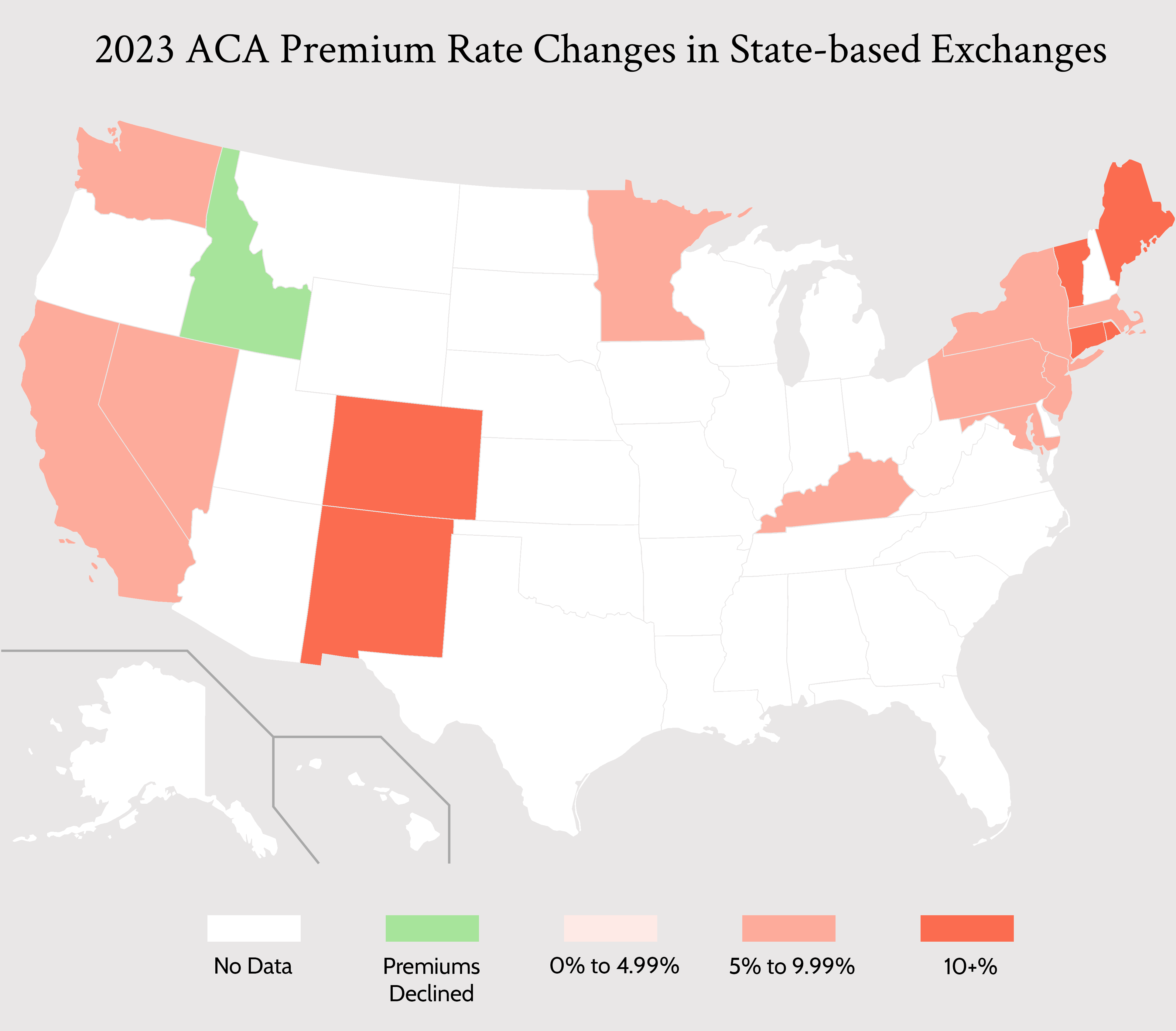

Where COVID dominated headlines in 2020 and 2021, inflation has been omnipresent in 2022. Which begs the question: Has inflation impacted health insurance premiums in 2023 in the Affordable Care Act (ACA) state exchanges?

To answer that question, here’s a look at announced ACA health 2023 insurance premiums in individual state markets for state-based ACA exchanges.

California

In July, Covered California announced preliminary rates would increase by 6%. The state, which has 1.7 million residents enrolled through Covered California, also announced:

- Aetna, a CVS Health company, would begin offering coverage in 7 counties.

- Anthem Blue Cross joined Blue Shield of California in selling health insurance plans statewide.

The state touts 13 carriers providing coverage. In California, 93% of residents can choose from three or more insurance carriers.

Covered California later tweeted that the average rate change would be 5.6% after Congress passed the Inflation Reduction Act and expanded ACA exchange subsidies through 2025.

Colorado

Preliminary premium rate filings showed an average increase of 11.3% for 2023. Bright Health recently announced it would no longer sell health plans in ACA exchanges. As a result, the state will have six insurers selling health plans on its exchange in 2023.

The Colorado Option Plan will be available in 2023 for the first time. In addition to standardizing plans and offering additional benefits like free primary care and mental health visits, the health plan aims to lower premiums by 5% in 2023, 10% in 2024, and 15% in 2025. 87% of Colorado residents will have access to Colorado Option Plans in 2023.

Connecticut

Insurers in Connecticut’s individual market requested rate increases of 20.4%. After public hearings, the state’s Insurance Department approved an average rate increase of 12.9%. The state has 206,000 residents enrolled in individual and small-group plans. Nine health insurers will offer health plans in the individual or small group market.

Idaho

Idaho published final state exchange premium rates that show an average decrease of 4% in 2023. The state has eight insurance companies offering plans in 2023. The premium decrease is likely due to the state’s Section 1332 waiver, effective January 1, 2023, that introduces a state reinsurance program.

Kentucky

Health plans submitted premium rate hikes averaging 8.2% in July. The state later approved premium rate hikes of 5.73%. Kentucky relaunched its Kynect state exchange for the 2022 plan year.

Maine

Maine announced in July that health insurers had preliminarily submitted an average rate increase of 14.72%. The final premium rate increase was 11.4% after a state review. The state has about 65,000 individuals who purchase insurance through the state exchange. Four health insurers will sell on the state exchange in 2023, including new entrant Taro Health. The state recently merged its individual and small-group risk pools, which led to a decrease in small-group premiums but may have contributed to the increase in individual premiums.

Maryland

Rates for individuals in Maryland’s state ACA exchange will increase by an average of 6.6% in 2023, down from the 11% insurers initially requested. The state has about 232,000 individuals enrolled in the state exchange. The state had four carriers propose rates for the 2023 plan year.

Massachusetts

Massachusetts’ Health Connector board approved an average 7.6% premium increase in the state’s individual market. Eight health insurers submitted health plans for 2023. Massachusetts has about 268,000 enrollees in the state exchange.

Minnesota

Minnesota’s finalized rate changes averaged over 7% from the six insurers who sell individual plans in the state. Four of the six insurers expect rate increases of less than 3%, while the remaining insurers plan increases of 18% and 22.2%. About 110,000 residents enrolled in plans through the state’s exchange in 2022. Every county in the state has at least two insurers offering health plans.

Nevada

Nevada residents can expect a weighted rate increase of 9.2% in the state’s health insurance exchange for 2023. Seven health insurance carriers offer plans through the state exchange, which enrolls approximately 100,000 residents.

New Jersey

New Jersey announced premium rate increases of 8.8% in its individual market. The state had seven insurers submit rates for that market, including new entrant Aetna. Over 300,000 residents enrolled in New Jersey’s state exchange in 2022.

New Mexico

New Mexico’s five health plans proposed rate increases averaging 11.3% for 2023. Additionally, Bright Health, the owner of True Health New Mexico, will not offer health plans in the state’s individual exchange in 2023. Roughly 45,000 New Mexicans enrolled through the state’s health insurance exchange.

New York

Health insurers in New York’s individual market initially requested an average rate increase of 18.7%, which the state’s Department of Financial Services reduced to a 9.7% average rate increase. Twelve health insurers offer health plans on the state’s exchange. About 262,000 residents enrolled in an exchange plan.

Pennsylvania

Residents will see an average 5.5% increase in Pennsylvania‘s state exchange in 2023. Nine health insurers will offer health plans in Pennsylvania, which enrolled more than 338,000 residents in 2022. Every county in Pennsylvania will have more than one insurer in 2023.

Rhode Island

Rhode Island’s two health insurers requested rate increases consisting of a weighted average of 8%. The state has about 42,000 residents enrolled in individual plans on the state’s exchange. The state later approved a 3.1% increase for BCBS of Rhode Island and an 8.2% increase for the Neighborhood Health Plan of Rhode Island.

Vermont

After two health insurers requested an average 19.4% premium rate increase in Vermont’s state exchange, the state’s Green Mountain Care Board reduced those rates to an average of 15% for 2023. About 30,000 individuals have enrolled in health insurance through the state’s exchange.

Washington

The average rate increase among 12 insurers in Washington’s health insurance exchange individual market was 8.8%. Two additional insurers were still under review. More than 200,000 state residents buy insurance through the individual market.

What are the primary drivers behind 2023 premium rate increases?

As you can see, most states with a state-based health insurance exchange are experiencing premium rate increases in 2023, most in the 8% to 10% range. Why? According to insurer filings, there seem to be two primary reasons:

- Doctors and hospitals are charging more for services. Like other businesses in an inflationary economy, the cost of healthcare services is rising.

- After the COVID pandemic drove down healthcare usage, individuals are returning to regular usage patterns, driving up healthcare spending.

Certifi helps state health insurance exchanges improve enrollment and build a better member experience with state insurance exchange premium billing and payment solutions.