Amazon rapidly evolved from an online bookseller to a behemoth with tentacles reaching into many corners of today’s economy. One of their challenges included building the cloud infrastructure necessary to handle an immense volume of online orders. Building that infrastructure required significant expenses and expertise.

As the story goes, when the leadership team met at a retreat in 2003, they went through an exercise to determine their core competencies. They thought it’d be a short discussion. What they soon realized was that they’d overlooked a competency that was unique at the time. They had built one of the largest cloud businesses in the world. Amazon was an expert at building scalable cloud infrastructure.

Amazon Web Services (AWS) wasn’t officially released until three years later. But the seed for a product that would turn what to that point had been a significant company expense into a revenue stream had been planted. In Q1 of 2021 that seed generated more than $13 billion in revenue. Today, it drives many of the Internet’s applications, including ours.

What can health insurers learn from the Amazon Web Services story? That there are revenue-generating activities that you may be overlooking. Here are two examples of how organizations are productizing core competencies to enable health insurance business growth beyond insurance premiums:

Oscar Health – Monetizing a Technology Platform.

Oscar Health started in 2012 intending to leverage technology to create a more consumer-centric approach to health care. As they state in the S-1 they filed when they decided to go public, “Too often, customers view legacy insurers as entities that merely take in monthly premiums and then pay medical claims. We aimed instead to serve as their guide to a confusing and fragmented system, helping them save money by optimizing their spending.”

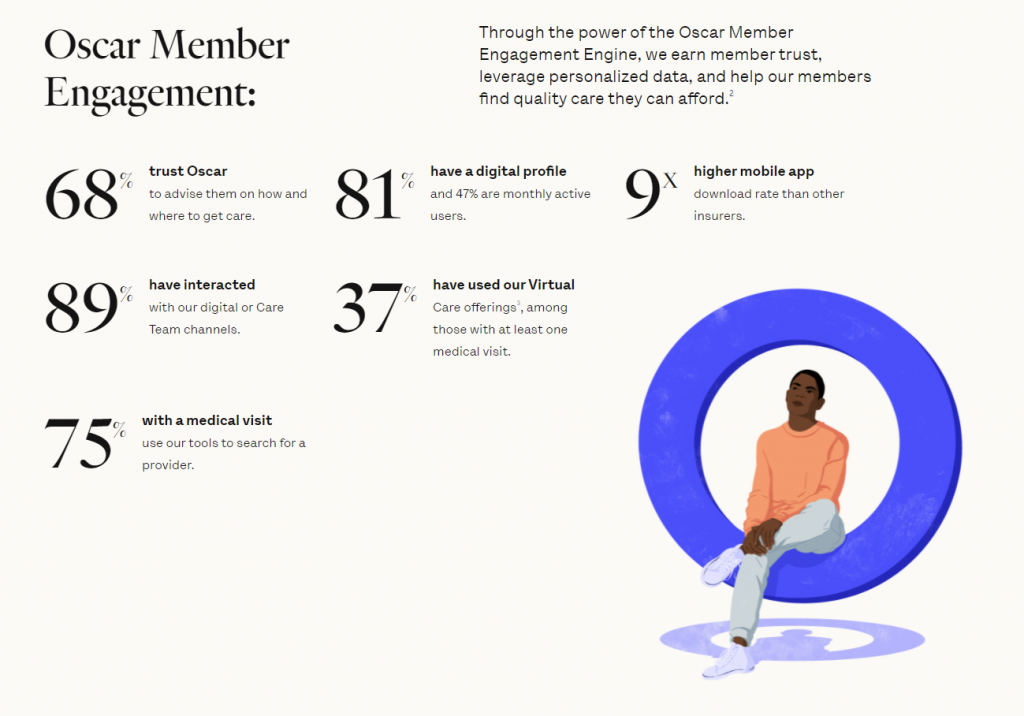

As a result, Oscar set out to build a full-stack technology platform designed specifically to improve member engagement. Today, they claim that platform has led to an NPS score of 30. Compare that to the 3 the average health insurance company earns.

And they recognize that their technology platform is an asset they can use to grow revenue. In 2020 Oscar grew its presence in the small group market with Cigna + Oscar co-branded plans that leveraged the company’s technology platform. And beginning in 2022, Oscar will perform administrative functions and deliver their technology platform to Health First’s individual and Medicare Advantage members.

Oscar will likely continue to monetize their technology platform in the future. In their S-1 they note that monetizing their platform through risk-sharing partnerships or fee-based service arrangements is one of their growth opportunities. They believe they’ll be able to diversify their revenue streams. Their investments in a member-focused technology platform will likely lead the way.

Highmark Health — Monetizing Business Transformation for Health Insurance Business Growth.

Highmark Health is a blended health care organization that includes Highmark Health Plans, one of the largest Blue Cross Blue Shield licensees in the US serving more than 6 million members in Pennsylvania, Delaware, West Virginia, and New York. The company also includes Allegheny Health Network. The health and wellness organization has more than 300 clinical facilities in Pennsylvania and New York.

Frankly, Highmark Health was the type of insurance company Oscar Health was looking to disrupt. Highmark was a long-standing insurance company focused on taking in monthly premiums and paying medical claims. The member experience was an afterthought.

But the health insurer has transformed recently and, like Oscar, started to focus on the member experience. Their Living Health initiative is designed to give members a personalized way to manage their health. Plus, they’ve redesigned their technology platform thanks to the help of Verily and Google Cloud to improve the member and physician experience.

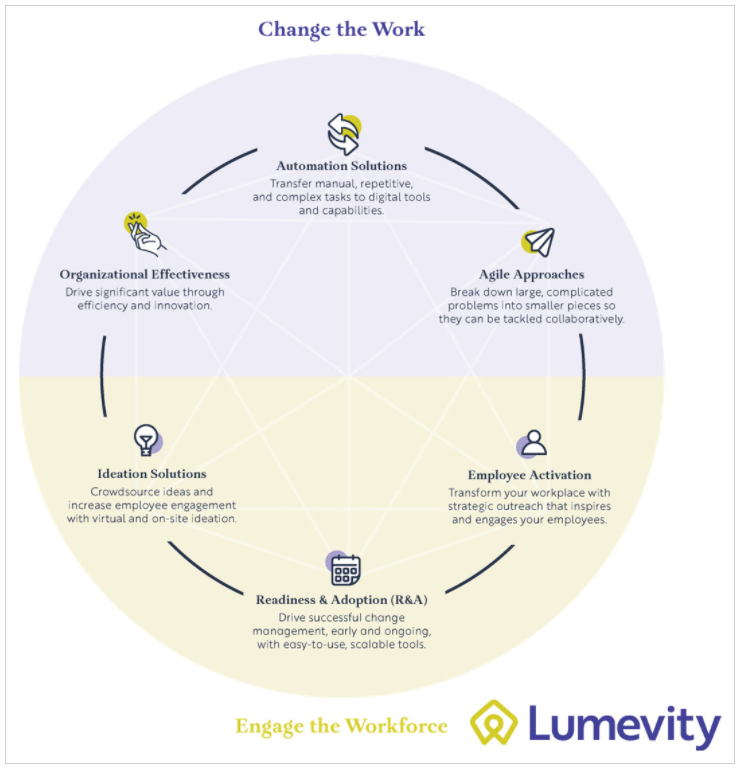

That transformation helped Highmark realize they had the team and experience to help others transform their businesses. Touting that their digital transformation helped them save more than $500 million, the organization recently revealed a new business, Lumevity, designed to help others achieve the same results.

Both insurers have recognized their core competencies consist of more than health insurance. In Oscar’s case, their competency includes technology. For Highmark, it’s business transformation. As a result, these companies have opened the door to new revenue streams that will help enhance health insurance business growth and competitiveness.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.