In Isaac Asimov’s classic Foundation series, a mathematician named Hari Seldon developed an algorithmic way to probabilistically predict the future. He was the father of psychohistory, which predicted the fall of the Galactic Empire. He then developed a plan to shorten the chaos that followed the empire’s collapse.

Health insurers have long used actuarial models to understand risks associated with insuring individuals and price health plans. But those actuarial models are being surpassed by predictive analytics models that generate insights from large amounts of data and more complex modeling. But instead of using these predictive models to reject individuals for coverage, health insurers are using them to match individuals with the right coverage and even the right medical care for their needs.

Like Hari Seldon’s psychohistory, these new predictive models could minimize the chaos involved with obtaining care. But, like psychohistory, they require a certain level of data literacy in health insurance that may require development.

Read on to learn more about data literacy in health insurance.

What is Data Literacy?

First, let’s define data literacy. Data literacy is the ability to read, work with, analyze and argue with data. But, data literacy is about more than numbers. It’s about:

-

Being able to understand data.

In big data environments like those in a health insurer, the ultimate goal is to be able to draw insights from all the data you’re collecting so you can make better, more informed decisions. So being able to translate data into insights is vital to your business success.

For example, assume you wanted to find the popularity of a new phone app feature and you perform an A/B test of two designs. You find that 65% of respondents indicate version A is easier to use than version B. Seems like you’ve found your design!

Maybe not, if your sample size is only 20 people vs. 10,000 people. In the 20-person group, 7 preferred version B. You likely don’t have a large enough sample size to draw any strong conclusions.

-

Being able to understand the implication of data sources and collection methods.

Data sources and collection methods can play a big role in what kind of conclusions can be drawn by a data set.

For example, say you ask a product manager why a feature hasn’t been added to a plan. That product manager points to a recent survey that showed few requests for that feature. The only problem: That survey included individuals that weren’t a member of that plan. And some of them were in health plans with that specific feature, so obviously they wouldn’t request it. If you don’t understand the underlying data collection methods you likely won’t get a complete picture of the data and won’t make the most informed decisions.

-

Being able to present your data.

Remember that your goal in analyzing data is to understand a problem. So presenting data in a way that doesn’t mislead but instead enables you to make decisions is important.

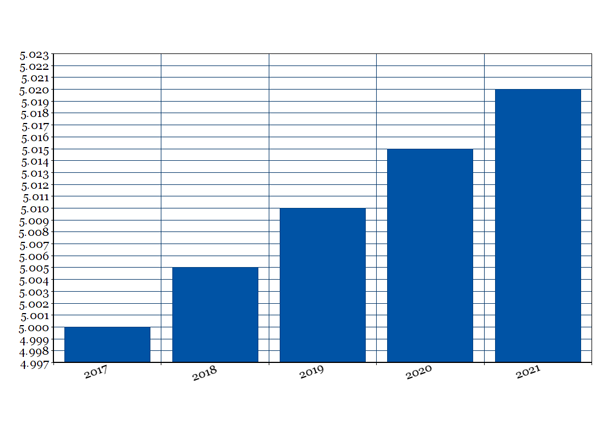

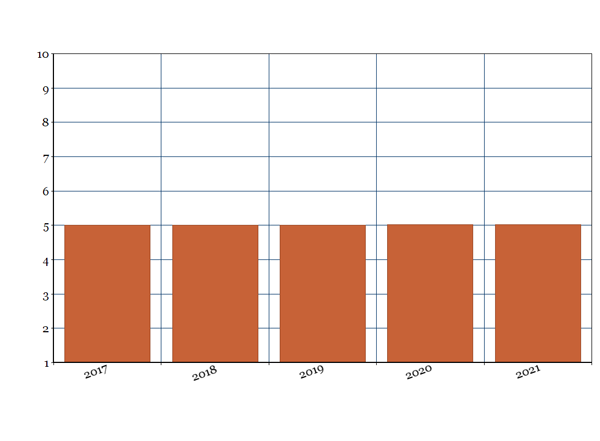

Take the two graphs below as an example. That’s the same data, but one seems to show a large increase while the other doesn’t because of the intervals used in the Y-axis.

Being able to present your data in a way that not only allows the data to speak for itself but also helps you make decisions is nearly as important as collecting and organizing the data in the first place. If you can’t, all that work collecting and analyzing your data is wasted.

Why should health insurers improve their data literacy?

Improving data literacy has several advantages. For example:

- It increases revenue. A McKinsey analysis found that high-performing organizations are three times more likely than others to say their data and analytics initiatives have contributed at least 20% to earnings over the past three years.

- It improves your ability to compete. For health insurers, many venture-backed competitors have entered the market over the past decade and almost all have touted their digital capabilities and advanced use of data. If you’re not investing in data literacy, you’ll likely fall behind these data-centric peers.

- It improves decision-making. Ultimately, improving data literacy will help you make better decisions based more on information and less on your gut or even who argues more persuasively.

How do you measure it?

Dataliteracy.com offers a team assessment they use to generate a data literacy score. The assessment contains 50 questions in 7 categories that team members complete. These scores are then averaged to get a company or team score.

That’s a formal way to calculate the data literacy in your business. But you can also use other, more informal ways to measure your data literacy. You could create a simple survey of organizational units that asks a series of questions about their uses of data to give you some insight into how your organization is leveraging data to make decisions.

Whatever you do, take an initial measurement and include periodic measurements to determine your progress toward your data literacy goal.

How does a health insurer improve data literacy?

Improving data literacy in health insurance is a process, not an event. Here are some tips to get you started:

-

Start with a goal and a plan.

You won’t see an improvement if you don’t set a goal or goals and then draft a plan that will help you achieve that goal. Many goals could be set. You could measure what percentage of your team passes a data literacy certification exam and set a goal to have a certain percentage pass the test by a specific date. Or you could create a data literacy training program and train a specific percentage of employees by a future date. Whatever goal you set, the next step is to craft a plan and communicate that plan to the organization. As with any plan, you must communicate the why behind the plan, not just the what. Becoming a more data-savvy organization will help your business better compete, but it also will help your employees grow and expand their skills, making them more valuable employees.

-

Lead by example.

A recent study by Accenture and Qlik found that only 32% of business executives said they can create measurable value from data and just 27% said their data and analytics projects produce actionable insights. If executives and leaders aren’t improving their data literacy game, it’s unlikely that rank and file employees will. To gain traction, you’ll need your leaders to lead the data literacy project. Ask them to analyze the data they have available within their teams and brainstorm uses of that data. Ask them to lead by leveraging data to gain insights. Teach them to hire, train, measure and promote employees based on easily understood plans and metrics. Inculcating a data-based approach within your business takes leadership by example.

-

Get the right tools.

You wouldn’t ask someone to dig a fence post hole with a screwdriver. So don’t ask your organization to be data literate if you’re not giving them the tools to do so.

As a marketer, I have a wealth of tools available to me to measure how my work is performing. I can see how many visitors, leads, and customers our website generates. A/B testing email campaigns and landing pages help me improve messaging and design. I can see how many likes and shares my social media activities have to pinpoint popular topics. I can report this data on a dashboard to see what’s working, what isn’t, and brainstorm improvement ideas based on that data.

If I couldn’t access that data, it would be difficult to measure and improve our marketing. Likewise, if your employees can’t access business data related to their jobs, they’ll be unable to leverage their data literacy skills to make sound decisions. So give them the tools they need to measure performance, customer satisfaction, provider network quality, member satisfaction, system performance, etc. Then, consider other tools that can unify the data your teams are creating to provide insights and guide decisions.

-

Leverage KPIs.

In high-performing companies, every employee has a number or numbers that they’re responsible for attaining. Then, those numbers roll up to their team’s goals and metrics, which in turn roll up to the company’s goals and metrics. That data-driven approach to performance helps businesses better achieve high-level goals while aligning employees around a common business objective. So leverage key performance indicators (KPIs) throughout your organization to measure and approve performance. For example, many health insurance member service teams will drop a screen with a dashboard among their member service reps so they can see the daily, weekly, or monthly key performance metrics. Many development teams monitor application performance with a large, centrally located dashboard. Those KPIs help businesses understand and correct performance in near real-time, improving outcomes.

-

Measure progress toward your goal.

Remember to frequently share progress toward your goal. If you create a plan, make sure the steps to achieving the goal are measurable so you understand your progress. By frequently communicating this progress, you’ll reinforce the value of the data literacy goal and nudge employees to do their part.

What Data Literacy Training is Available to Employees?

The Data Literacy Project, started by data analytics company Qlik and other organizations and academics, offers an assessment, training, and a data literacy certification. Another analytics company, Tableau also offers data literacy training. Dataliteracy.com is another source for data literacy training and certification. LinkedIn Learning offers a data fluency course. Kubicle also offers a data literacy course.

Those options are general data literacy training, but for a deeper dive into healthcare data specifically, Coursera offers a course in healthcare data literacy.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.