In late March, the Office of the Actuary in the Centers for Medicare and Medicaid Services (CMS) released their annual projections for US healthcare spending. These projections analyze several categories by the spending source of funds, the type of service, and by the sponsor. They examine the years 2021 through 2030.

How much will the US spend on healthcare? Read on to learn about projected US healthcare spending through 2030:

National Health Expenditure Projections

Overall, CMS projects US healthcare spending to match the gross domestic product (GDP) over the next decade. They project both to grow at 5.1% per year. With the pandemic receding, the expectation is that healthcare utilization will return to normal by the end of 2024. The receding pandemic will also cause government spending on healthcare to decline. Government spending will fall from 51% of healthcare expenditures in 2020 down to 46% by 2024. The pandemic also caused the insured rate to increase — thanks to Medicaid temporarily suspending redeterminations as well as expanded subsidies on the ACA exchanges. CMS projects that the insured rate will decline as a result. The insured rate will fall from 91.1% in 2022 down to 90.5% in 2030.

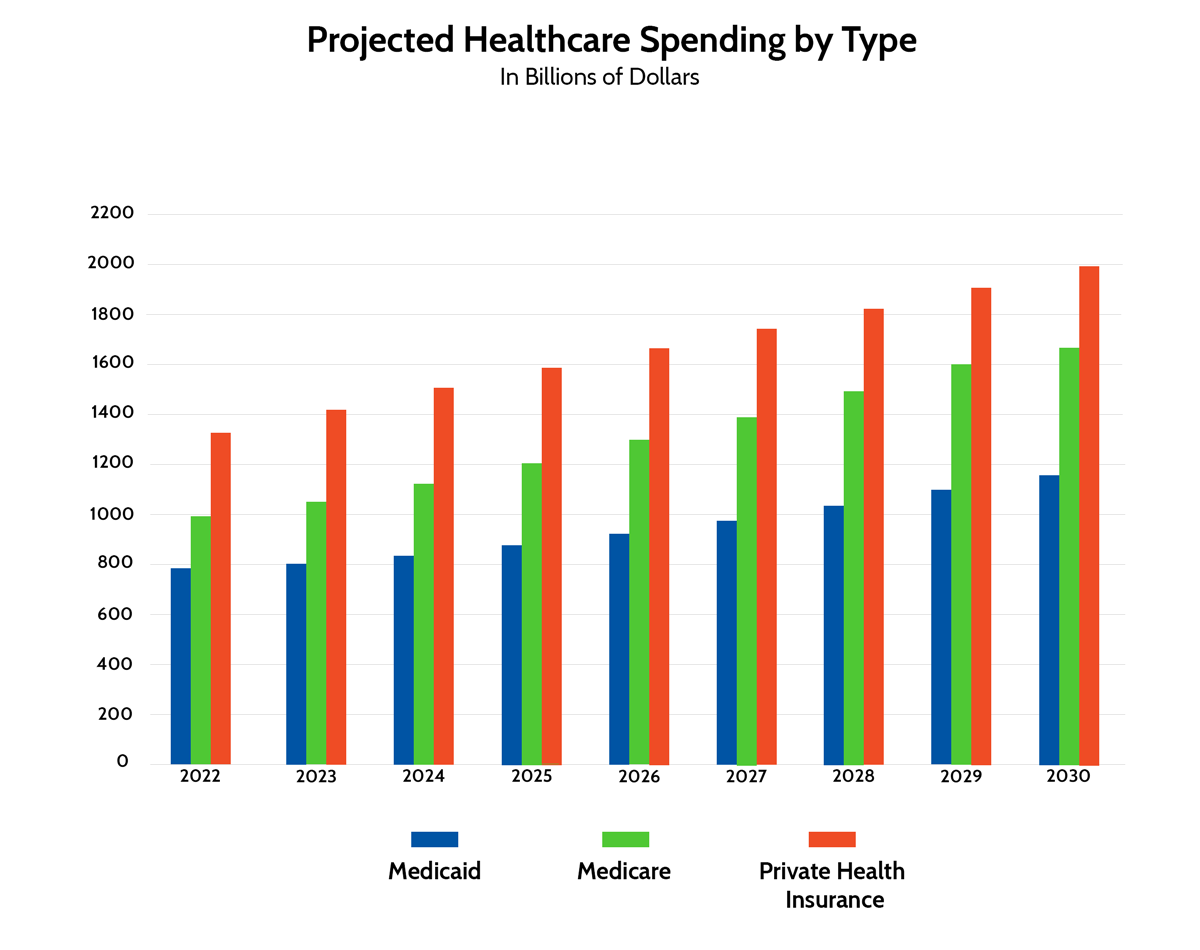

Let’s take a look at what CMS projects healthcare spending by specific payers looks like over the next several years.

Projected Medicare Spending

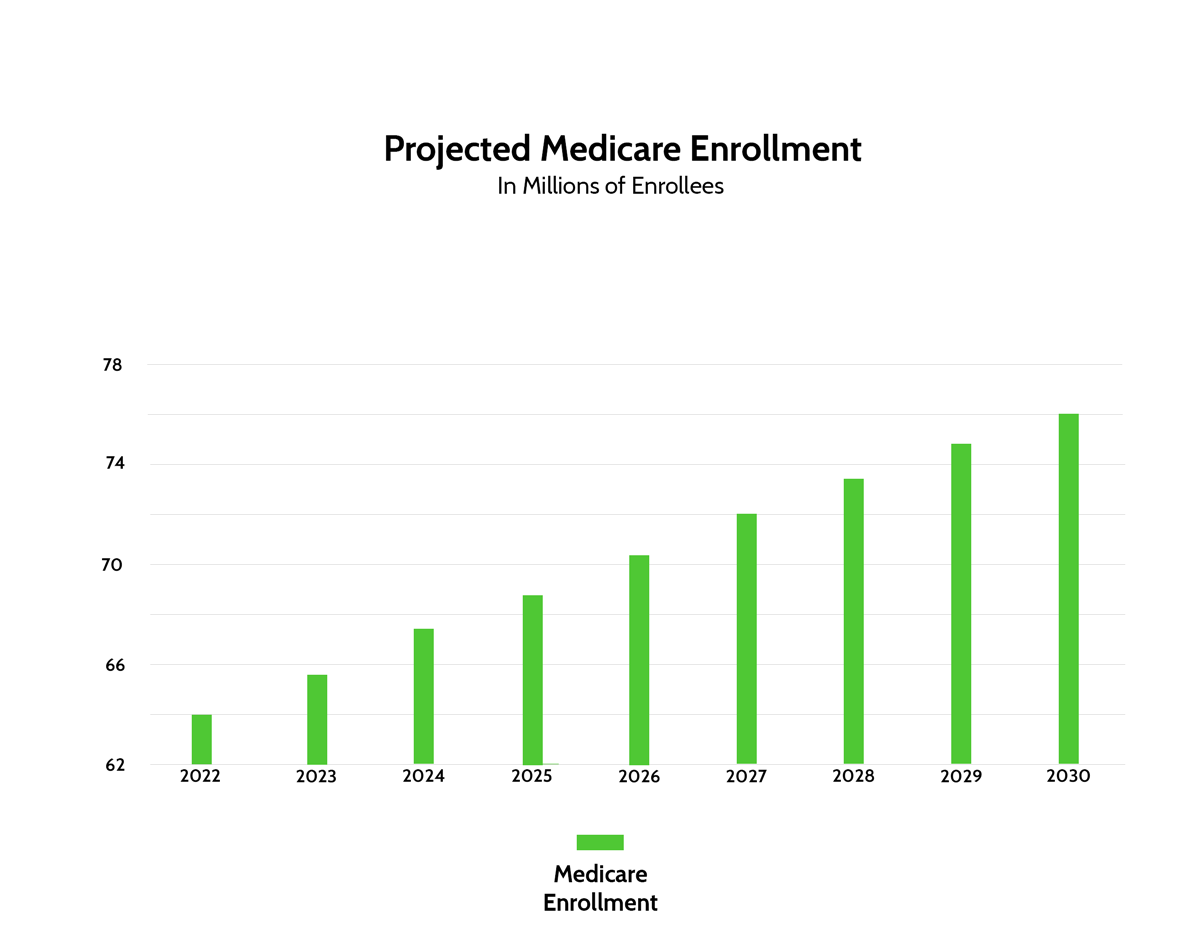

Medicare expenditures increased by a remarkable 11.3% in 2021. CMS expects Medicare spending will drop to between 7% and 7.5% increases for most years from 2022 to 2029, with only a 5.9% increase in 2023. The spike in 2021 is due to Medicare beneficiaries accessing patient services at a higher rate than in the 2020 pandemic year. The decline in 2023 marks a return to normal utilization. Interestingly, 2030 could portend the start of slowing Medicare expenditures. In 2029 the last of the baby boomer generation will enroll in Medicare. Also, larger payment rate cuts under current laws could lead to a spending decline. As a result, the projections foresee just a 4.3% increase in Medicare spending in 2030.

Those spending increases translate to Medicare expenditures going from just under $1 trillion in 2022 to nearly $1.7 trillion in 2030. Medicare is expected to go from 21.5% of national health expenditures in 2021 to 24.7% by 2030.

From an enrollment perspective, CMS expects Medicare to increase from 62.5 million enrollees in 2021 to 76 million by 2030. Year-over-year enrollment growth rates will peak in 2023 at 2.6% before starting to slowly decline to 1.6% by 2030. Finally, spending per enrollee will increase from $14,759 in 2021 to nearly $22,000 per enrollee by 2030.

Projected Medicaid Spending

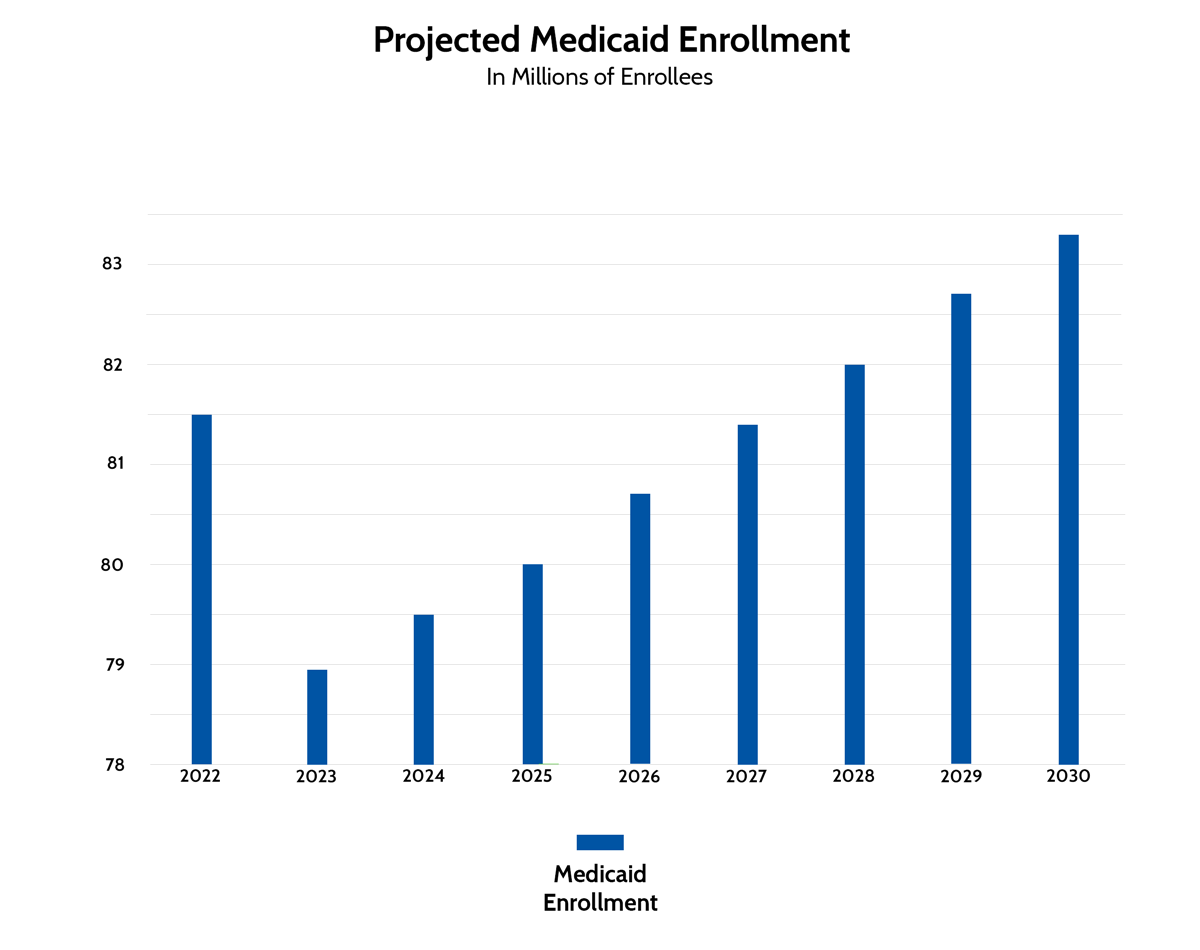

As we previously mentioned, Medicaid’s maintenance of eligibility provision enforced during the pandemic has led to a surge in Medicaid enrollment. However, it’s likely the government ends the Public Health Emergency behind that maintenance of eligibility provision soon. Afterward, states will have a year to redetermine Medicaid eligibility for all beneficiaries. That leads to 10.4% spending growth in 2021, but by 2023, just 2.7% growth. By 2025, spending growth will normalize, annually increasing by between 5.1 and 6.3%. In actual dollars, that translates to spending growing from just under $750 billion in 2021 to over $1.1 trillion in 2030. That spending increase is tied to enrollment increases. But the increase also results from the disproportionate share payment cap reductions that are set to expire in 2027. CMS expects that to lead to higher hospital spending.

As a percentage of national health expenditure, Medicaid will go from about 17.4% down to 16.8% in 2027. Then, its share will grow to 17.2% in 2030. As far as enrollment, Medicaid enrollment is expected to decline from 82.2 million to 81.5 million in 2022. Enrollment will decline further to 78.9 million in 2023, before starting to rise, going as high as 83.3 million in 2030. The growth is not only because of expected population growth but also assumes states will expand Medicaid programs. That will lead to average per-beneficiary spending rising from just over $9,000 in 2021 to nearly $14,000 by 2030.

Projected Private Health Insurance Spending

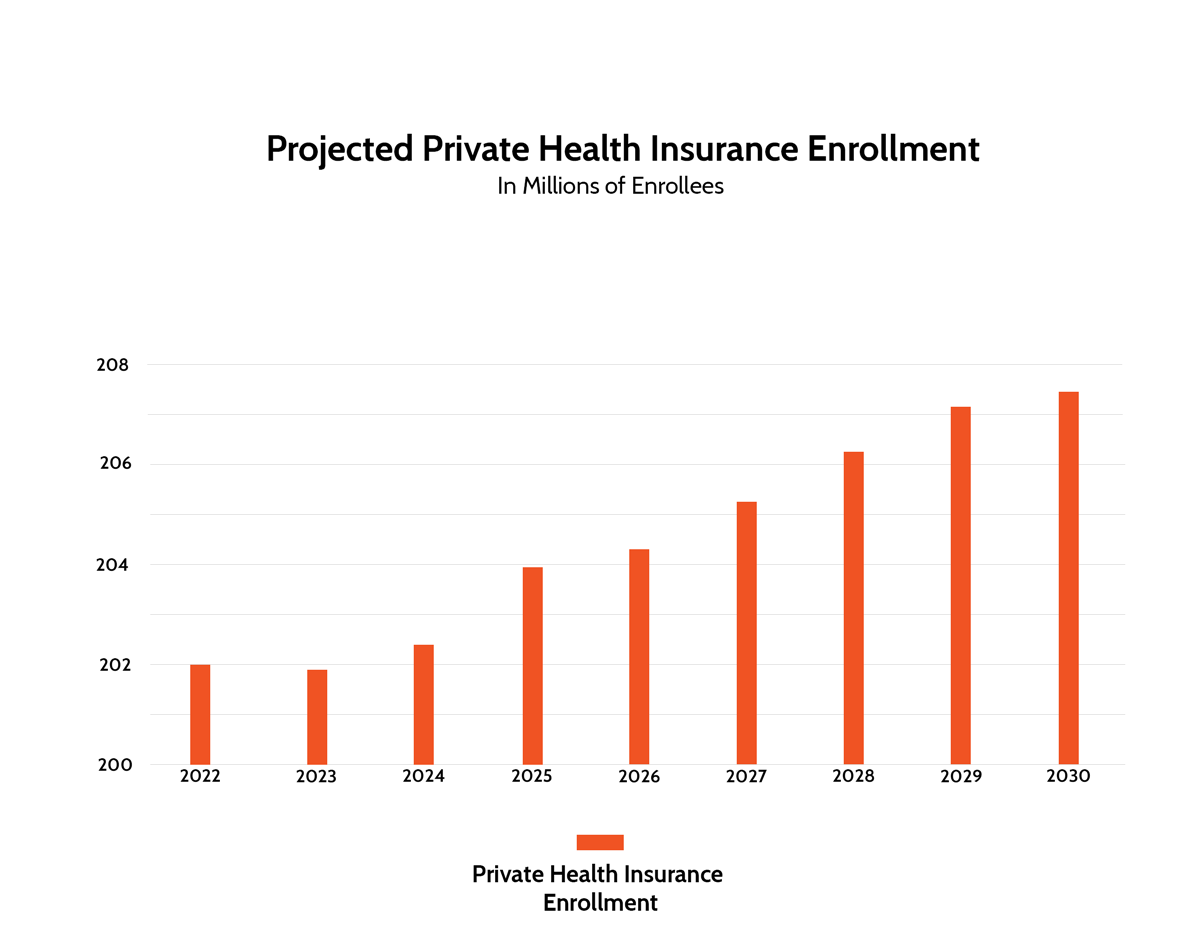

Private health insurance spending declined in 2020, but that portends increases in spending in 2021 through 2024. CMS projects private health insurance spending to increase 8.3% in 2022, 7.1% in 2023, and 6.2% in 2024 before seeing a 5.4% increase in spending in 2025 and falling under 5% from 2026 to 2030. Why does CMS expect those increases? Increased demand for health care services post-pandemic. CMS also projects that private health insurance spending will continue to be the largest slice of the healthcare expenditure pie. Health insurance spending will account for 29.5% of expenditures in 2022, growing to 30.4% by 2025, before falling back down to 29.6% by 3030. Much of that growth early is likely attributable to Medicaid beneficiaries transferring to insurance rolls. The decline late this decade likely is a result of more Boomers enrolling in Medicare.

From an expenditure perspective, private health insurance will grow from $1.2 trillion to nearly $2 trillion from 2021 to 2030. CMS expects enrollment in private health insurance to grow from about 202 million in 2021 to nearly 208 million in 2030. Most of that growth will come from consumers directly purchasing insurance — either a Medicare supplemental or individually purchased plan — which sees growth from 28.8 million in 2021 to 34.1 million in 2030. Comparatively, CMS projects employer-sponsored insurance to stay relatively flat, going from 174.5 million in 2022 and 174.7 million in 2030.

Per enrollee spending for private health insurance is expected to rise from $6,567 in 2022 to $9,608 in 2030. Employer-sponsored insurance will experience similar per-enrollee spending, increasing from $6,774 in 2022 to $10,035 in 2030.

Takeaways

Overall, CMS expects the pandemic to impact healthcare expenditures in the short term before leveling off for the second half of the decade. Demographic shifts may play in role in enrollment numbers and expenditure growth, with Medicaid likely losing enrollees and experiencing decreased revenue short-term. Medicare, meanwhile, will continue steady enrollment and expenditure growth that may subside beginning in 2030 as Boomer enrollment wanes. Employer-sponsored insurance will be relatively stable through 2030 while individually-purchased plans will increase, likely due to increased Medicare sales and potentially from those dropping from Medicaid roles transitioning to marketplace plans.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.