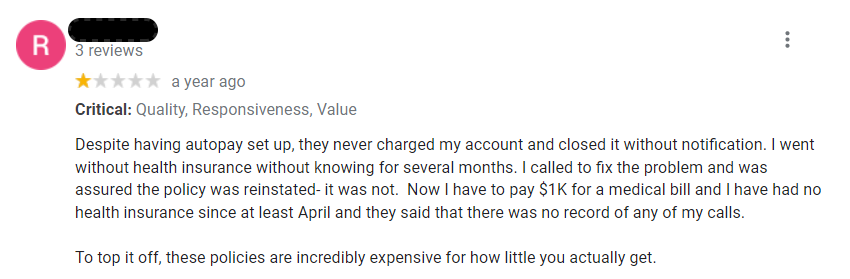

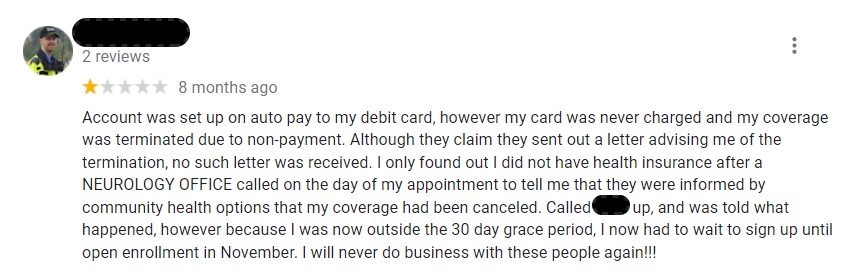

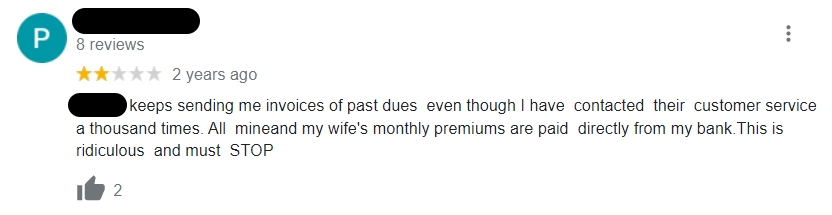

Do you have Google reviews like this?

For those in ACA or Medicare Advantage markets billing premiums directly to individuals, negative reviews like these can be enrollment killers. And enrollment killers can be revenue killers.

That’s why the system you use to bill is vital. Yet, health insurers often overlook those billing systems.

Traditionally, core admin software solutions bundle premium billing functionality with their other features. But most core admin providers built those solutions to handle a vastly different function. Whether that’s claims administration or enrollment data management, the majority of core admin solutions were not built to manage premium billing. Instead, these companies saw an additional revenue opportunity and built mediocre billing solutions that only meet basic premium billing needs.

It’s similar to the success Google had transitioning from a search engine to a social media company. That’s why you’ll find that many core admin solutions include premium billing as a bundled solution. You get it whether you want it or not. And as a result, many insurers choose to use the solution. Not because it’s great, but because it’s there and doesn’t incur an additional cost.

But that doesn’t mean it’s adequate. Here are the four main reasons your core admin premium billing solution is inadequate.

The expertise required to manage claims is much different than premium billing.

Many core admin solutions — and their underlying technologies and database architectures — were built decades ago. At the time, the claim was the dominant item the technology was structured around. Why? Because most providers built core admin solutions to manage claims. And the health insurance business was largely based on a fee-for-service model in which health insurers paid providers based on services rendered.

As the health insurance market changed, many core admin solutions changed their architecture so that they could also manage the developing value-based payment model. In that model, the insurer makes a payment less rooted in the services offered, and more rooted in patient outcomes. That meant insurers designed solutions around the contract because that contract drives the payment.

But neither of these architectures is constructed to fit the premium billing model. Premium billing centers around an individual. Those crafting an integrated core admin billing solution find that architecture to be a foreign paradigm. It may seem like a simple paradigm shift to architect software around an individual. But even once architected correctly, billing has many idiosyncrasies that require a deep understanding of premium billing. Most core admin developers haven’t encountered these idiosyncrasies. And by the time they do, billing errors have already occurred.

Core admin premium billing solutions are inflexible.

During the COVID-19 pandemic, insurers wanted to extend payment grace periods. Or, they wanted to eliminate terminating employers and individuals if they failed to make a payment within the usual grace period. For many core admin solutions, that meant time-consuming – and costly – code changes because of their lack of flexibility.

But solutions designed for premium billing typically are much more flexible. Changing grace periods, delinquency rules, or pro-ration rules don’t require code changes. As a result, health insurers can quickly implement new products with more robust billing and delinquency rules. Or, they can adjust rules — like grace periods during a pandemic — without the need for limited development resources.

Core admin premium billing software doesn’t scale.

Though many have updated their underlying technologies, on-premises deployments still dominate core admin system installs. Why does that matter? Typically, on-premise solutions require hardware to run. As a result, they require additional hardware to scale. Over time, if you aren’t adding additional hardware, those solutions may slow down. In a billing world where generating tens or hundreds of thousands of invoices every month consumes a lot of resources, that can be expensive, time-consuming, or both.

Modern cloud solutions can scale dynamically, simply adding server resources when necessary. That means they can scale up and down as needs dictate. In the short and long term that translates to faster transaction generation and likely reduced costs.

Worst of all, core admin billing systems are inaccurate.

We opened this post by looking at three reviews that highlight the impact inaccurate premium billing can have on an insurer’s member satisfaction. Those reviews were all likely the result of inaccurate billing or poor billing processes.

Because core admin solutions typically see premium billing as an afterthought, they often fail to supply the resources required to build a best-in-class billing solution. Their systems may simply be point-in-time billing systems. The insurer will generate invoices on a specific day of the month — say the 15th. Those invoices will be based on enrollment data on that date.

What happens when a termination occurs on the 14th but isn’t reflected in the enrollment platform until the 16th? Those point-in-time systems require significant manual reconciliation and review to adjust the next bill. That manual reconciliation is the result of their architecture. The core admin solution isn’t built around an individual. Plus, core admin systems view enrollment data as the single source of truth when generating billing transactions, not the billing transactions themselves.

What’s the solution? A system designed from the ground up to manage premium billing. A solution that includes billing and rate setup rules and applies them to enrollment data. A system that ingests enrollment data, but serves as the source of truth for all premium billing transactions. A billing solution designed to automate retroactive reconciliation by automatically creating all the necessary adjustments — both to premiums and premium subsidies as well as to remittance amounts — based on effective and termination dates. Ultimately, you need a system designed for the unique task that is premium billing.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member satisfaction while reducing administrative costs.